Elevate Your Finances with the Powerful Apple Card

Elevate Your Finances. Transform Your Finances with Apple Card. Launched on August 20, 2019, Apple Card is not just any credit card; it represents a revolutionary shift in how we manage our finances. Created by Apple and backed by Goldman Sachs, this innovative financial tool offers a seamless integration of technology and user experience. If you’re considering a credit card that maximizes rewards while minimizing hassle, the Apple Card is worth exploring. Let’s delve into its features, application process, and benefits to understand why it’s becoming the go-to choice for many consumers.

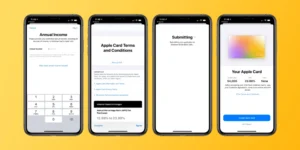

Streamlined Application Process

Applying for an Apple Card is designed to be incredibly user-friendly. You can apply directly through the Wallet app on your iPhone. Once you receive an invitation, the app pre-fills much of your information using your Apple ID, including your name, address, and phone number. You’ll just need to input your annual income before agreeing to the Terms and Conditions.

After submitting your application, it goes to Goldman Sachs for approval. If approved, you can request a physical titanium Apple Card, which typically arrives within 6 to 8 business days. This simplicity and speed in the application process make Apple Card an attractive option for anyone looking to manage their finances more effectively.

Understanding Approval Odds

The Apple Card features variable APRs ranging from 10.99% to 21.99%, depending on your creditworthiness. Several factors can influence your approval odds:

- Payment history and any outstanding debt obligations.

- Existing public records, such as bankruptcies or collections.

- Your overall debt levels relative to your income.

- Frequency of recent credit applications.

- Your credit score, particularly if it falls below 600.

Goldman Sachs uses TransUnion and other credit bureaus to assess your application, making it essential to be aware of your credit score before applying.

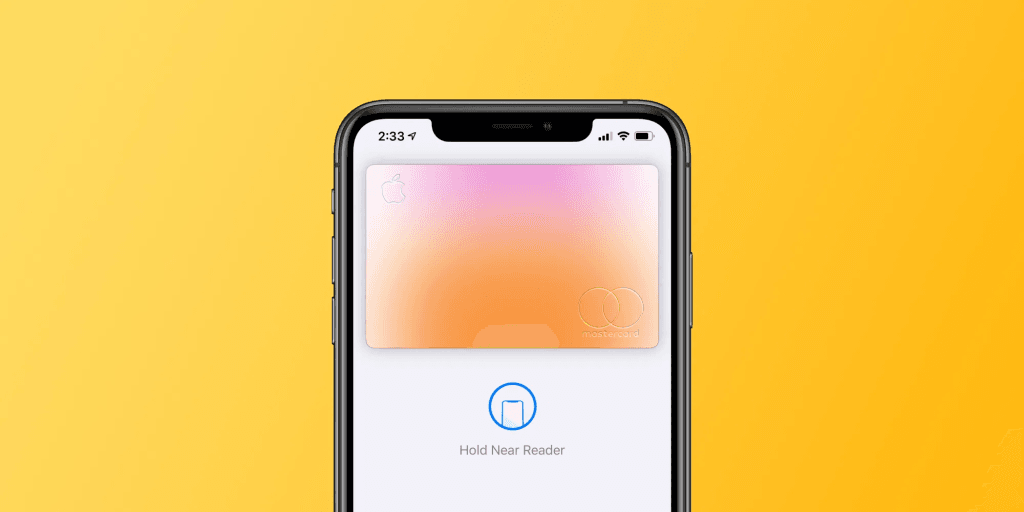

The Wallet App Integration

Apple Card is managed entirely through the Wallet app, providing a streamlined experience that integrates seamlessly with your Apple ecosystem. You don’t have to log into a separate app to check your balance or transactions, making it convenient to manage your finances on the go.

Elevate Your Finances

The virtual card design features a dynamic heat map that reflects your spending categories. For instance, if you frequently shop at Starbucks or make App Store purchases, the card will display a mix of colors representing those transactions. This visual representation of spending habits helps you stay on top of your finances while making it easier to see where your money goes.

Elevate Your Finances

Hassle-Free Payments and Customer Support

With Apple Card, managing payments is straightforward. You can choose to pay your full balance, your statement balance, or any amount you prefer. The app also provides detailed information about interest fees associated with each payment option and allows you to set up autopay to align with your paydays.

Need assistance? Tapping the three dots in the upper-right corner of the Apple Card interface connects you to support through Apple Business Chat, online, or via phone. You can manage scheduled payments, view your credit details, and even request a new card number if your card is compromised—all from within the Wallet app.

Elevate Your Finances

Impressive Rewards Structure

While some credit cards offer higher cashback rates, Apple Card’s rewards structure is straightforward and user-friendly. You earn 3% cashback on Apple purchases, 2% on Apple Pay transactions, and 1% on all other purchases made with the physical card. The transactions list in the Wallet app clearly shows your earnings, making it easy to track your rewards.

Elevate Your Finances

Some of the 3% partners include:

- Apple

- Uber and Uber Eats

- Walgreens

- T-Mobile

- Nike

- Exxon and Mobil

- Panera Bread

If you frequently utilize Apple services or shop at these partners, the cashback can accumulate quickly.

Daily Cash Rewards

One standout feature of the Apple Card is the “Daily Cash” rewards system. Rather than waiting for a monthly statement, you receive cashback at the end of each day. This means you can either spend your Daily Cash immediately using Apple Pay or transfer it to your bank account, providing you with immediate access to your rewards.

0% Financing Options

For those looking to purchase Apple products, Apple Card offers 0% financing on eligible items. This includes a range of products, such as iPhones, iPads, Macs, AirPods, and accessories. Financing options vary by product, with higher-priced items offering up to 12 months of 0% interest. For example:

- MacBook Pro financing starts at $199.91 per month for 12 months.

- AirPods Pro can be financed for 6 months at about $41.50 per month.

This flexibility allows you to invest in high-quality products without the burden of immediate full payment.

No Hidden Fees

One of the most appealing aspects of Apple Card is that it comes with no fees. This includes foreign transaction fees, annual fees, balance transfer fees, and more. Many credit cards with lucrative rewards come with steep annual fees, but Apple Card eliminates this concern, making it an attractive option for rewards shopping.

Elevate Your Finances

Apple Card Family

In a move to foster family financial management, Apple introduced the Apple Card Family feature. This allows users to share their Apple Card with up to five family members. All participants must be part of the same Family Sharing group and must be at least 13 years old. This feature promotes financial responsibility, as all users can build credit together while managing a shared credit limit and spending transparency.

Elevate Your Finances

Conclusion

In conclusion, the Apple Card is a groundbreaking financial tool designed to simplify credit card management while maximizing rewards. With its seamless integration into the Apple ecosystem, straightforward application process, and impressive rewards structure, it’s no wonder that more consumers are turning to Apple Card for their financial needs. Whether you’re looking for a credit card that rewards you for everyday purchases or one that offers 0% financing on Apple products, Apple Card stands out as a powerful choice. Transform your financial experience today by exploring what Apple Card has to offer!

Elevate Your Finances

Elevate Your Finances

Elevate Your Finances

1 thought on “Elevate Your Finances with the Powerful Apple Card”

Comments are closed.