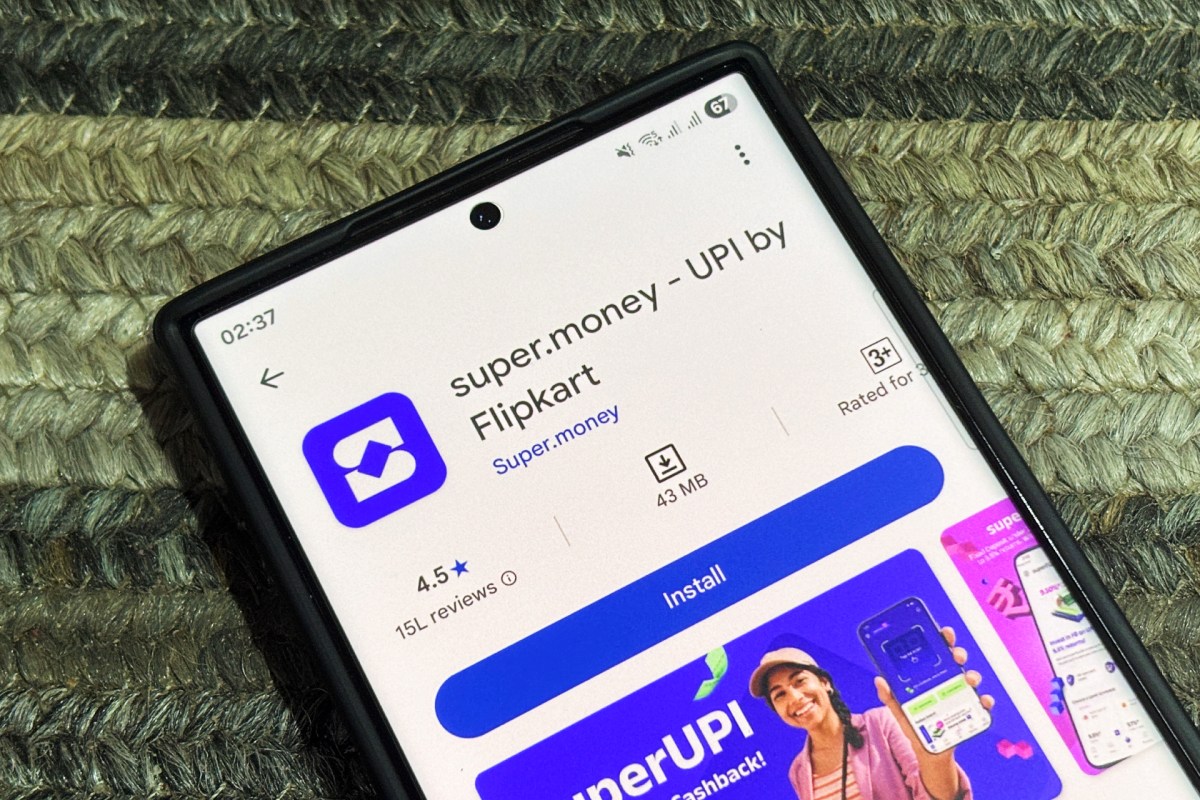

What’s new — flipkart

Super.money, the fintech arm of Flipkart, is making headlines as it prepares to raise a significant round of funding aimed at achieving a $1 billion valuation. This comes on the heels of securing $50 million from its parent company, Flipkart, enhancing its capacity to innovate and expand its financial services offerings in a competitive marketplace.

Why it matters

This development is particularly significant for US readers as the fintech landscape continues to evolve rapidly. With giants like PayPal, Square, and Venmo dominating the market, Super.money’s entrance could potentially reshape user preferences and redefine how financial transactions are approached. The rise of alternatives to traditional banking in the US mirrors trends seen in emerging markets like India, where Flipkart operates. Understanding Super.money’s approach can offer insights into how companies adapt financial services to meet local needs and preferences.

Key details

- Fresh story

- Source: techcrunch.com

- Fintech Sector Growth: The global fintech sector is projected to grow at an unprecedented rate, with innovations in payment systems, lending, and personal finance management.

- Market Trends: US consumers are increasingly turning to mobile payment options and digital wallets, making it essential for new entrants to offer competitive features and robust security measures.

- Competitive Landscape: Companies like Robinhood and Chime are reshaping how financial services are delivered in the US, providing rapid, user-friendly solutions that appeal to younger demographics.

- Investment Opportunities: Investors are keeping a close eye on fintech startups, particularly those that successfully integrate technology with personalization in their offerings.

Pros and cons

Pros

- Useful update: The information about Super.money highlights an important trend in fintech that could impact consumers and investors alike.

- Innovation potential: With substantial backing, Super.money could introduce innovative solutions appealing to younger, tech-savvy consumers.

- Market disruption: New competitors can lead to better prices and services for consumers in the fintech space.

Cons

- Limited details yet: While the announcement is promising, specifics about product offerings and market strategy are still sparse.

- Competitive risks: As a new player, Super.money faces significant challenges in establishing brand recognition against established rivals.

- Regulatory hurdles: Navigating financial regulations in multiple markets, including the US, could hinder rapid expansion.

What to watch

In the coming months, it will be crucial to watch for further developments, including potential partnerships and product launches that could define Super.money’s market strategy. An analysis of user response to their offerings will also be telling, as consumer satisfaction will play a significant role in their growth trajectory.

Bottom line

This latest venture by Flipkart’s fintech division is one to watch closely for anyone interested in the evolving landscape of financial services. As new developments unfold, including updates on funding and strategic partnerships, we’ll keep you posted with the latest insights.

Source: techcrunch.com